The National Taxpayers Association (NTA), alongside key stakeholders, has called for accountability following a report alleging a $28 million tax discrepancy involving British American Tobacco Kenya (BAT Kenya) for the 2017/2018 fiscal year. Published by the University of Bath’s Tobacco Control Research Group, The Investigative Desk, and Tax Justice Network Africa (TJNA), the report has raised concerns about potential tax evasion and illicit financial flows.

The investigation found that BAT Kenya failed to report $94 million in cigarette sales, leading to an estimated KSh 30 billion in lost profits between 2010 and 2023. The findings suggest deliberate tax evasion, particularly during the 2017/2018 fiscal year, a period marked by significant infrastructure investments, including transformer installations across Kenya.

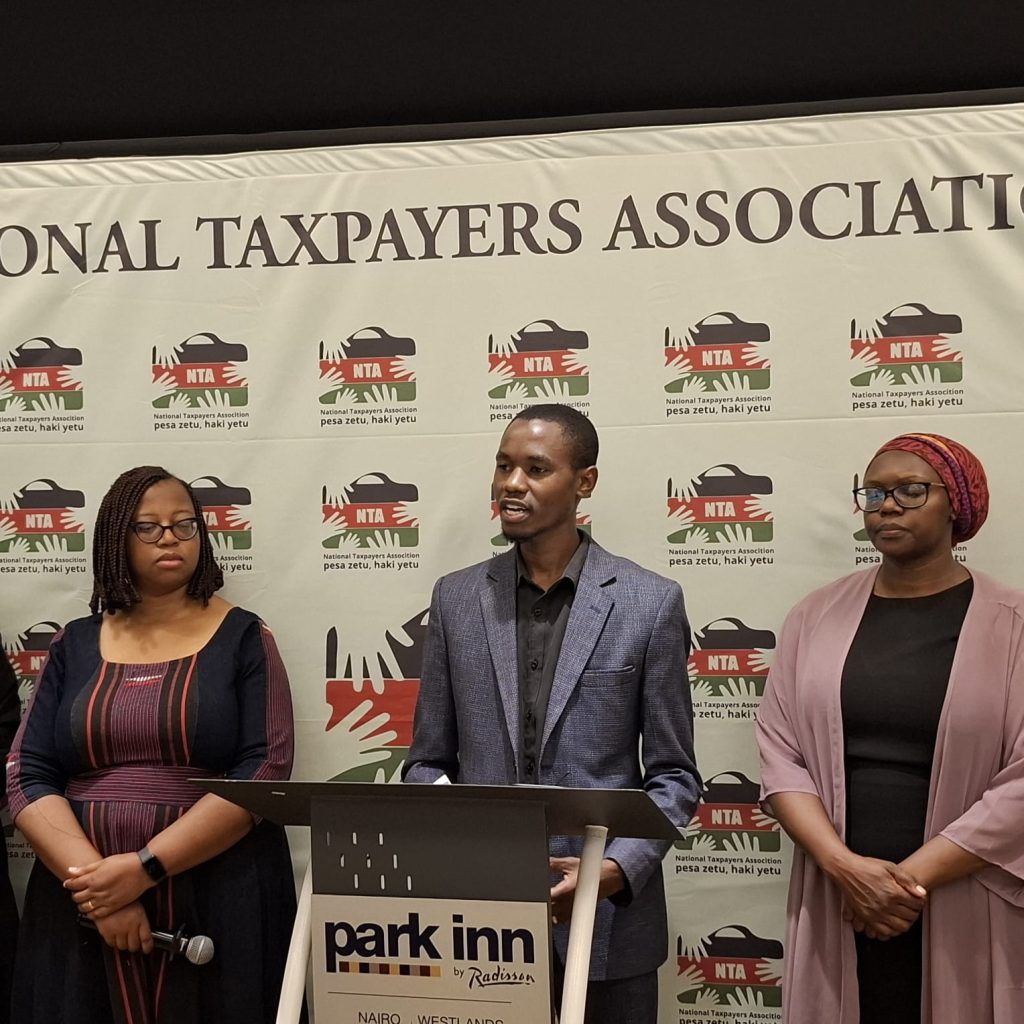

At a stakeholders’ breakfast meeting organized by the NTA, Ms. Irene Otieno, the NTA National Coordinator, expressed shock. “BAT Kenya has received numerous awards as a leading taxpayer. However, this report highlights serious irregularities in their financial disclosures,” she said. Ms. Otieno also criticized the government for continuing to view BAT Kenya as a valuable contributor despite the allegations.

“This is not just about BAT Kenya; it’s about setting a precedent for corporate accountability and safeguarding Kenya’s public health and economic future,” Ms. Otieno said.

She emphasized the broader implications of the alleged discrepancy, especially given Kenya’s healthcare funding challenges. “The $28 million could address significant shortfalls in Kenya’s health budget, particularly in fighting cancer, which has devastated many families,” she added. Ms. Otieno urged the Kenya Revenue Authority (KRA) to address corporate tax evasion with the same urgency as individual tax compliance.

BAT Kenya has denied the allegations, calling the report “based on erroneous assumptions and misrepresentations.” The company insists it complies with all financial disclosure regulations and international standards. Meanwhile, the KRA has acknowledged the seriousness of the allegations and promised a thorough review. In a statement, the KRA reaffirmed its commitment to tax compliance and vowed to take action if tax evasion is confirmed.

John Thomi, Policy Officer for Tax and Equity at TJNA, stressed the need for broader advocacy and systemic reforms. “We cannot expect different results by doing the same thing. This issue goes beyond tobacco control; it’s about ensuring corporate accountability and fair taxation,” he said. Thomi added that TJNA is mobilizing non-traditional advocates, including religious organizations and the public, to demand transparency and justice.

Rachel Kitonyo-Devotsu, a Senior Tobacco Advisor with the Tobacco Control Data Initiative, called for a forensic audit. “We cannot accept BAT Kenya’s denials without verification. A forensic audit is crucial to uncover the truth and ensure the Tobacco Control Fund receives its rightful share,” she said. The fund relies on a 2.75% contribution from BAT’s profits. Kitonyo-Devotsu also urged greater transparency in managing the fund, noting that the alleged $28 million could significantly support cancer treatment and tobacco control efforts.

The NTA’s call for accountability comes amid growing public dissatisfaction with Kenya’s tax system. While individual taxpayers face increasing burdens, allegations of corporate tax evasion persist. As the government prepares for the upcoming budget cycle, stakeholders are urging policymakers to prioritize reforms and ensure corporations pay their fair share.

The NTA and its partners have pledged to intensify advocacy efforts. They plan to engage legislators, parliamentary committees, and the public to push for action.