M-KOPA Dominates Consumer Finance Debate as New Report Shows Strong Trust and Fair Lending

By Peace Muthoka.

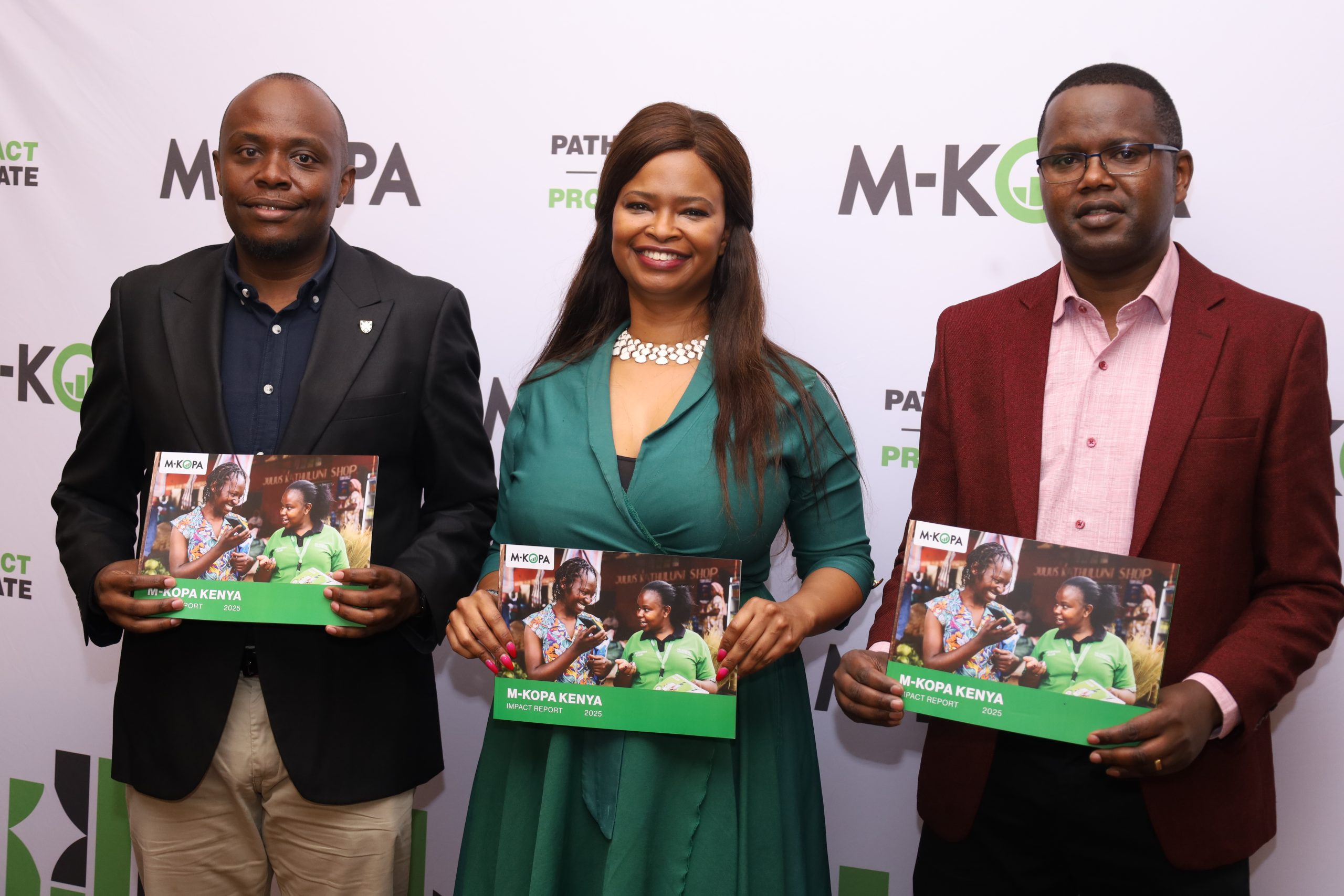

M-KOPA yesterday released its 2025 Kenya Impact Report, revealing overwhelming customer trust in its financial model and positioning the company as a leading force in Kenya’s digital finance and climate-smart innovation space. The report highlights major economic, social, and environmental gains, even as debates on predatory lending intensify across the country.

According to the findings, 95% of M-KOPA customers say the company’s loan terms are fair, a strong endorsement in a market where many consumers routinely face hidden charges, aggressive debt collectors, and harsh penalties. The company attributes this trust to its transparent onboarding process. Every customer receives a welcome call where the loan terms are clearly explained, ensuring that no one commits to a contract they do not understand. Additionally, the company maintains a strict policy of no hidden fees, no penalties for delayed payments, and no negative impact on customers’ credit histories.

As the country continues to express concern over rising consumer indebtedness, M-KOPA emphasised its device-locking technology as a major safeguard for customers. Unlike traditional loan models where missed payments quickly accumulate, pushing borrowers into deep debt, M-KOPA ensures that customers never owe money for a device they cannot access. When payments are missed, the device simply locks, and the skipped days are added to the repayment period without any penalty. Moreover, customers are free to return their devices at any time and receive a full refund of their deposit with no further obligation. This flexibility protects families from spiralling debt—a growing crisis in Kenya’s consumer finance sector.

This customer-centric model is a sharp contrast to the irresponsible financing practices that have become common across the industry. Many lenders subject customers to aggressive follow-up, repossession of household assets, and growing penalties that deepen vulnerability. M-KOPA says its experience proves that digital lending can be both sustainable and humane without compromising business growth.

The report also underscores M-KOPA’s expanding contribution to climate-responsible growth. While the company initially built its name through solar home systems, it has since broadened into refurbished smartphones and circularity programmes. Through these green initiatives, M-KOPA has avoided 2.03 million tonnes of CO₂e since 2010, reinforcing its role in supporting Kenya’s transition to a low-carbon economy.

Economically, the company’s footprint continues to widen. The 2025 report shows that M-KOPA has unlocked over KES 207 billion in credit, enabling millions of low-income earners to afford essential digital devices that improve daily life and productivity. In 2024 alone, the company contributed KES 3.79 billion in taxes and spent KES 20.3 billion on local procurement, demonstrating its deep integration into the national economy. Its smartphone assembly plant—now recognised as the largest in Africa—has already produced 2 million locally assembled phones, strengthening Kenya’s manufacturing ambitions under Vision 2030.

Customer impact also forms a major part of the report. M-KOPA has served 4.8 million customers, with nine out of ten reporting an improved quality of life. Additionally, 67% use their devices for income generation, and 52% report increased earnings, pointing to the company’s growing influence on livelihoods and economic empowerment.

Looking ahead, M-KOPA plans to expand local manufacturing, scale its responsible digital financial services, and strengthen partnerships aligned with national development priorities such as the Digital Economy Blueprint and Kenya Vision 2030. The company says it will continue pushing for financial inclusion while deepening its climate-smart operations.

With strong customer approval, measurable climate action, and a growing economic footprint, M-KOPA’s latest impact report positions the company as a central player in shaping Kenya’s future in digital finance and sustainable development.